As with all businesses, a sustainable stream of income is essential to the survival of architecture firms. The most innovative and beautiful designs in the world count for nothing if you are not paid for your work, preferably on time and with a regular cadence. Given the stark consequences of failure in this area, it is essential that architects maintain best practices when it comes to their finances, as well as training younger staff members to understand and value the importance of payment processes.

The following tips form a helpful guide for architects looking to get paid quicker and more regularly, as well as fostering a culture of transparency that will help maintain a positive relationship between the firm and its clients.

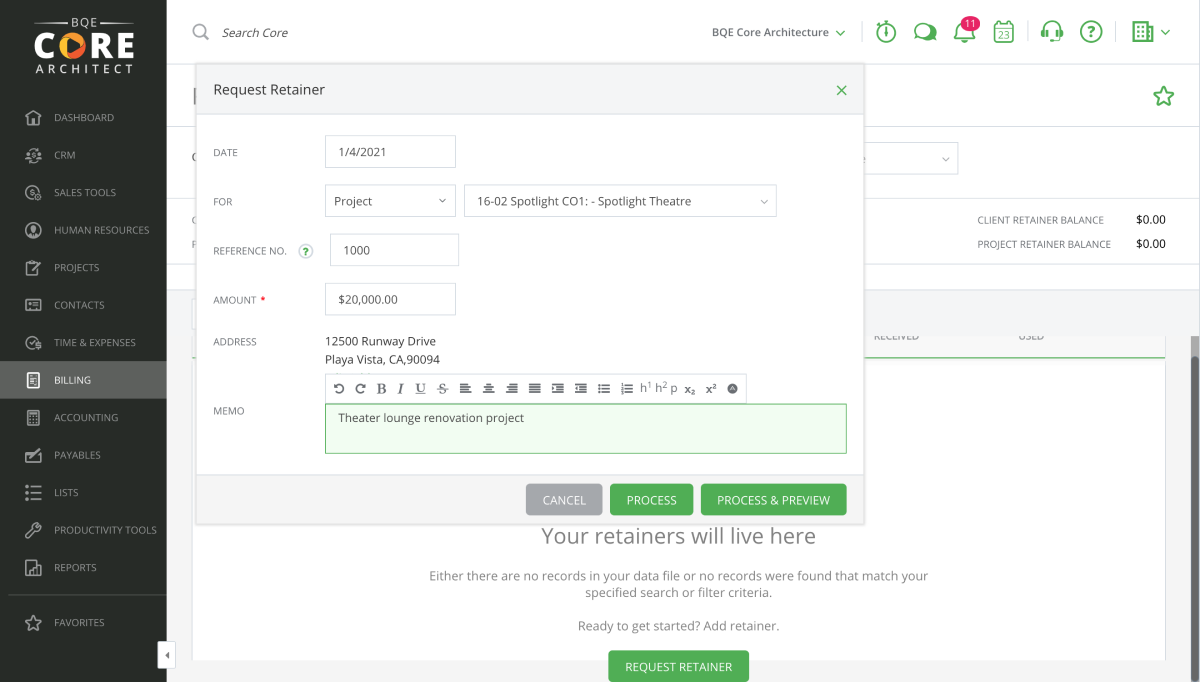

1. Charge a retainer at the outset of a project.

It is vital to secure a deposit or retainer when you begin working on a project, so that you have some form of security in the event of unforeseen circumstances. If you don’t and something happens to your clients or their company, you may never be able to recoup fees for the hours you and your staff worked since your last invoice. Calculate the monthly fee you’re going to charge your client, and bill them one month in advance. In order to receive payment in a timely manner, don’t make the project status “active” in your billing system until you have the retainer money in hand.

2. Include no-charge items on invoices.

It’s always worth displaying no-charge line items on your invoices, so that your clients can see the entire scope of your work and understand that they are receiving select services for no additional fee. This shows your client the real value of the service you are providing them. Additionally, this makes it easier to justify charging for the same services later, because your client will know you’ve already done them the favor of performing those services for free several times.

Image via BQE

3. Add markups on reimbursable expenses.

Billable hours extend further than you might expect, and these should not be ignored by architects looking to run a sustainable business. You should add a markup to your reimbursable expenses — typically around 10 to 20% — to cover the time your team spends planning and managing them. For example, it takes time to plan a trip and organize accommodation for regular site visits. You should charge your clients a markup to cover the time spent to get it all done.

4. Charge interest on late payments.

Including interest on late payments is the best way to incentivize your clients to pay you on time. If you don’t charge a penalty, your bill will not be a priority for busy people juggling multiple invoices. If you are worried about how this might affect your relationship with your client, just remember — charging additional fees on late payments is standard in any service industry, whether it’s for your lawyer or your gas company. As long as you clearly state the consequences of late payment in your contract, there should be no misunderstandings.

5. Break down your completed tasks on invoices.

Always itemize the tasks you have carried out within each bill, complete with the hours taken to complete them. This transparency will benefit you in multiple ways — first, your client can clearly see where their money is going and understand the full value of the service you are providing. Secondly, if they ask you to do additional work, you can justify charging more for these services. Finally, it helps build trust in your organization, showing your client that you are diligent and detail-oriented.

Image via BQE

6. Automate your invoices.

If you’re still manually creating every invoice, you’re costing yourself valuable time that you could be using to design, plan and strategize for your firm. Much of the work involved in compiling invoices involves repetitive tasks, so the process lends itself to automation. There are now sophisticated yet easy-to-use platforms that will automate your billing process and save you hours or even days each month. Automating your invoices will increase your cash flow by creating a predictable and straightforward billing process that both your firm and your clients are familiar with.

7. Accept payment via credit/debit cards, and ACH

If you want to improve cash flow, it’s vital to make it as easy as possible for clients to pay you. Make online payment portals available to clients so they can pay by credit cards, debit cards, and eChecks, and mention the benefits to them (faster, more convenient, more secure for both parties, and so on). If the portal is integrated with your overall firm management solution, the payment record is entered automatically, further simplifying administrative tasks for staff.

Implementing the above guidelines will provide you with a solid foundation for building a financially viable architecture firm in the long term. Once you have these fundamentals in place, you can focus your energy on satisfying your existing clients and earning new commissions, creating a business that is successful and sustainable in equal measure.

You can learn more about improving invoicing practices in the ebook 5 Billing Practices That Are Killing Your Business by BQE Software, the creators of BQE CORE Architect, the smart cloud practice management solution that lets you efficiently and productively handle all your project management, time and expense tracking, invoicing, accounting, HR, and client relationship management on a single platform. To see how your firm can speed up the payment process with BQE CORE Architect, click here.