Lior Schnabel is Co-Managing Partner at Precise, a company that provides financial management and control services for architectural and engineering firms across the USA and Europe.

A common complaint among A/E firm managers is, “If I’ve got such great projects, how come I’m not making enough money?” The way to improve your profitability begins with managing the profitability of your projects. Perfection is in the details, and if you don’t see the full picture of each project, it’s impossible to be 100% efficient and reach your profit goals.

To ensure the firm reaches its full profit potential, there are several crucial points that you need to cover:

- Manage projects profitability

- Make sure the hourly cost is correct

- Track project efficiency and profitability on a real-time basis

- Recognize changes, orders, etc.

An A/E firm that’s not doing ALL the above will simply NOT reach its profit potential. Managing the details is imperative to stay efficient. But is that enough? A common assumption among A/E firm directors is, “If all of my projects are profitable, then the firm is profitable.” The problem is that it ain’t necessarily so.

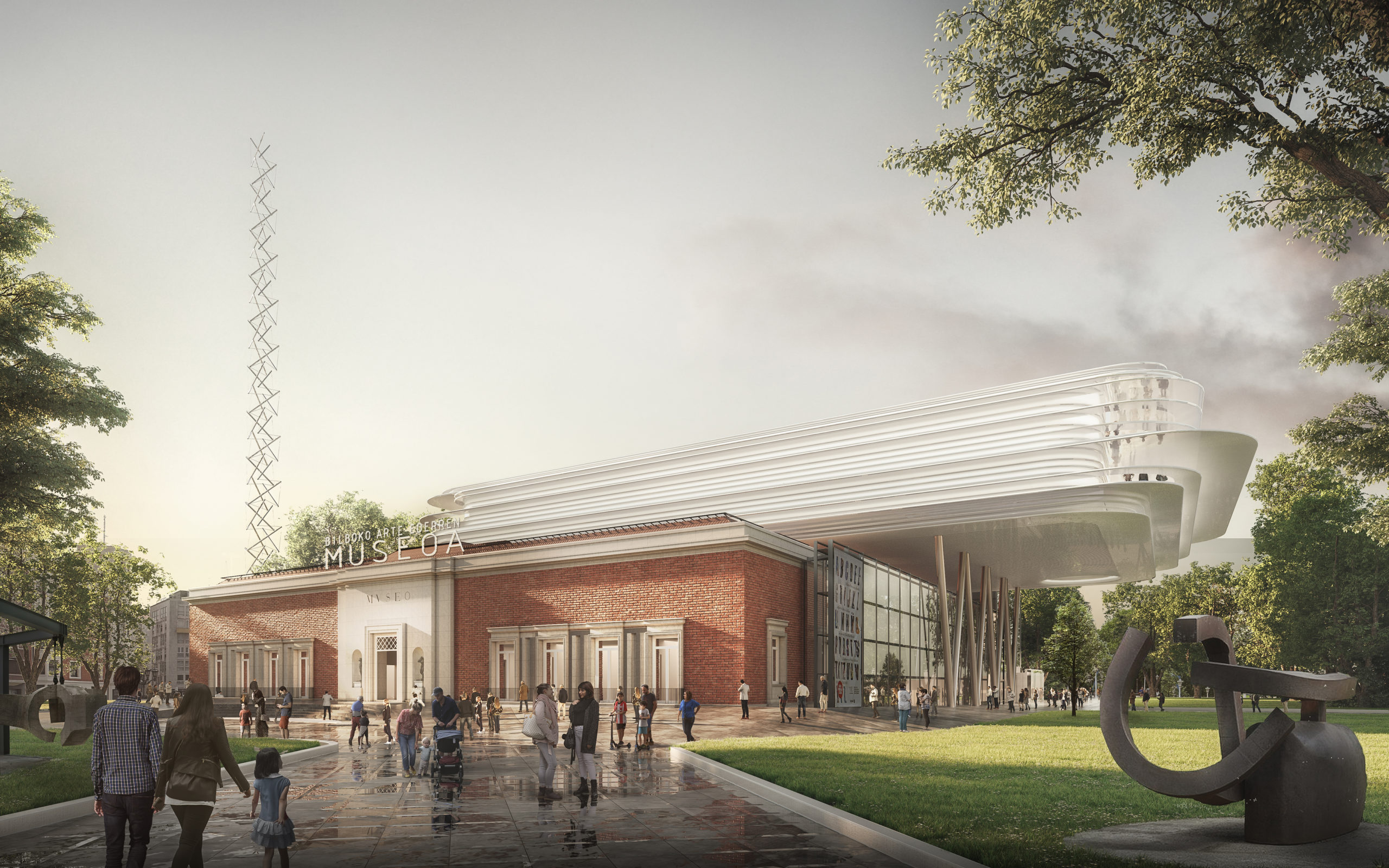

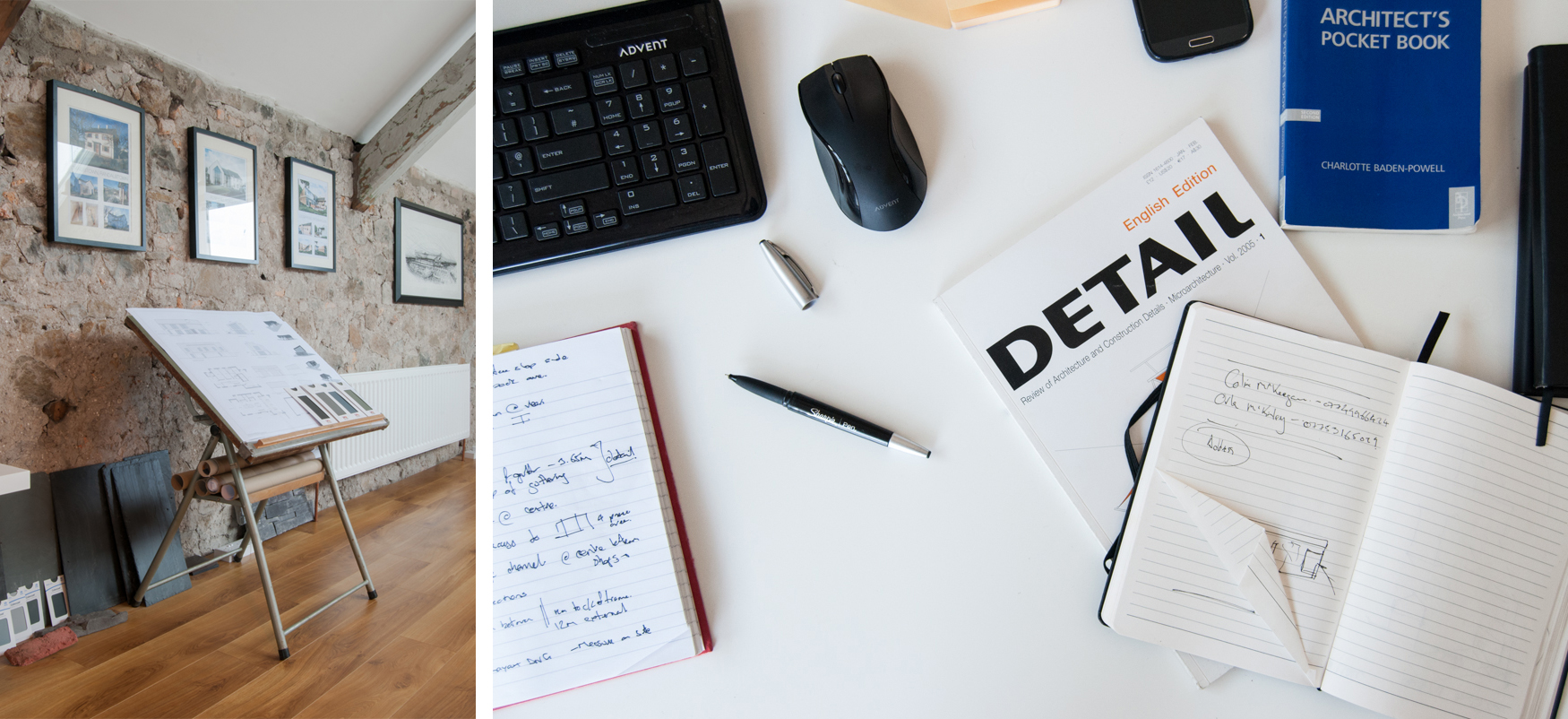

Slemish Design Studio Architects Office by Slemish Design Studio Architects, Ballymena, United Kingdom

Here are 2 examples:

1. Timing

For example, a firm has a few big projects that started in 2020 and the initial phases (1+2) showed a 30% profit in 2020. In 2021, however, the firm continues to work on the next project phases (3+4) and the bottom line for phases 3+4 shows a 15% loss. If we check the projects’ overall profitability, we see that the project is still profitable, but in 2021 the firm is actively losing money

2. Reduced Utilization

If we calculate the cost of a particular employee (let’s call her Susan for this example) according to 1,800 billable hours per year, and our annual cost for Susan — including wages and overheads — is $180,000, then our hourly cost is $100. Now, let’s say Susan worked only 1,400 billable hours in 2021. Therefore, according to the firm metrics, the cost of Susan’s projects in 2021 comes down to $140,000.

If the income on Susan’s projects was $154,000, her projects show a profit of $14,000. The problem is that there are an additional 400 non-billable hours valued at $40,000 (400 hours x $100/hour) that were not accounted for. So, actually, there’s a loss of $26,000 ($180K cost vs. $154K revenue).

Timing and utilization are just two examples of how profitable projects do not always translate to overall profitability.

To ensure the firm overall profitability we must meet the firm revenue objectives while not exceeding your expense budget!

Slemish Design Studio Architects Office by Slemish Design Studio Architects, Ballymena, United Kingdom

Assume your monthly breakeven point (total of monthly expenses) is $800,000, your revenue objective is $1,000,000, and you meet your revenue/billing/new contract objectives every month. You’ll show a year-end profit of 20% ($12M revenue vs $9.6M expenses). That’s obvious.

There should be no conflict between the firm’s profitability and the projects’ profitability because they go hand in hand. Proper pricing combined with ongoing project monitoring are key elements in maintaining profitability. However, if you need to choose between specific project profitability and firm profitability, choose the firm.

For example, if there are no new projects coming in at the right fee, utilization is going down, and projections are under the billing objective. In this case, it will make sense (from a financial point of view) to take on a “losing” short-term project to “close the gap”.

Here’s a quick case study: Assuming our hourly cost is $100 ($50 wages + $50 overhead), and we have the opportunity to bill $75 per hour for a short-term project. If everybody is busy, utilization is OK, and we’re meeting the firm’s objectives, it’s a no-brainer – we won’t do it.

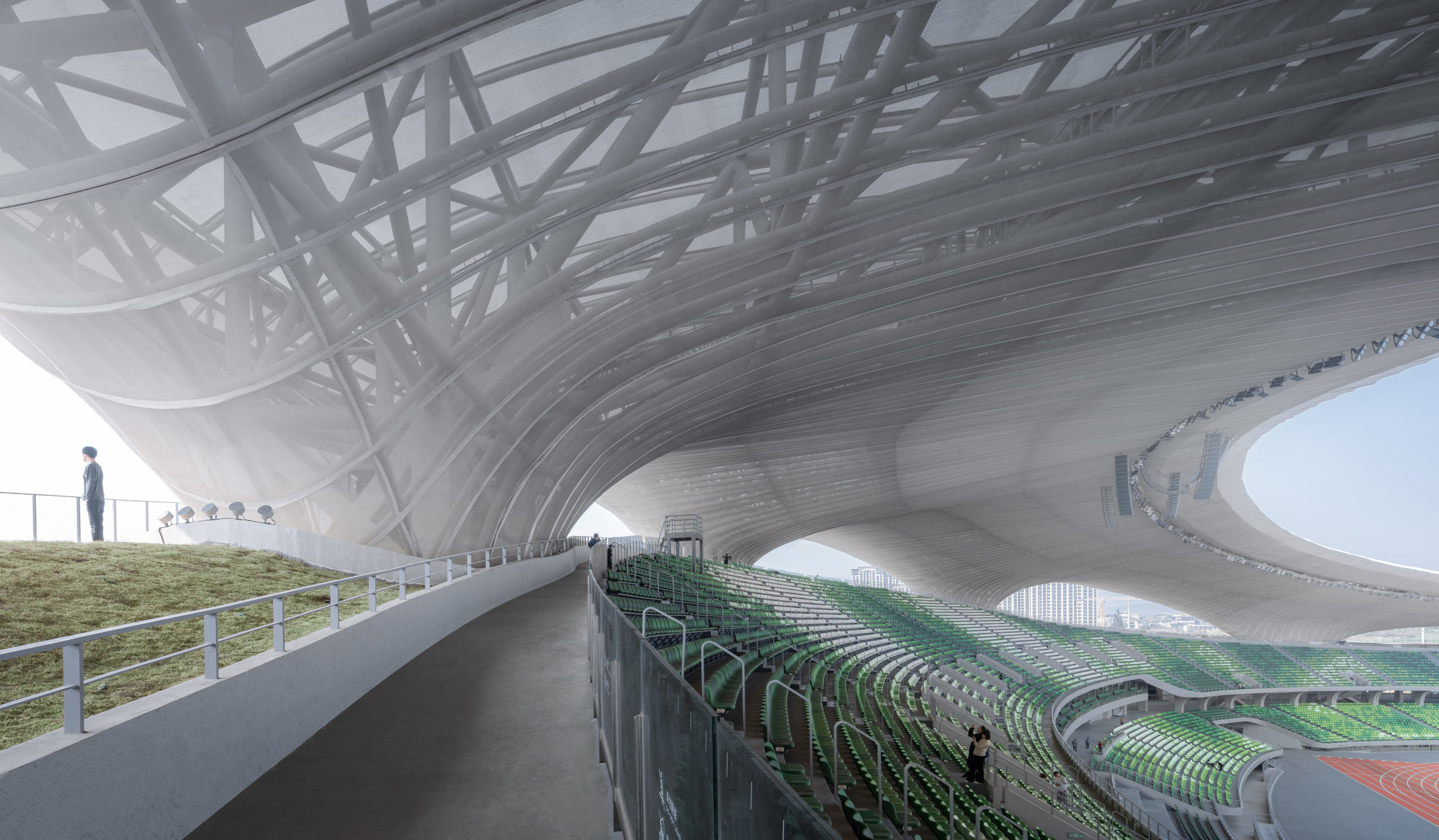

Slemish Design Studio Architects Office by Slemish Design Studio Architects, Ballymena, United Kingdom

Now let’s examine that same situation, but with low workload in the firm (no new projects on the horizon, utilization going down, etc.) under 3 different scenarios:

1. Not taking the project and keeping the staff

In this case, we’d keep on paying $100 per hour with $0 income, racking up a loss of $100 per hour on those unutilized hours.

2. Not taking the project and letting a staff member go

In this case, we’d still pay the $50 per hour in overhead (we will spread it over the other staff, but it won’t go away), resulting in a $50 per hour loss.

3. Taking the project and keeping the staff

In this case, we’d keep on paying $100 per hour, but we’d be making $75 per hour in income, so the loss would be $25 per hour on those unutilized hours.

So, we have three bad options. Of course, we will try to get projects with a higher fee but between these three options, financially, option # 3 is preferable.

Summary

Of course, pricing strategy is more complicated than this simple case study. A/E firms need to consider their branding and positioning and ascertain the appropriate fees for their talent, knowledge, and quality of service. And although project monitoring is one of the keys to profitability, it’s not enough.

When it comes to managing an A/E firm, we need to focus on meeting the firm’s financial goals (revenue/billing/new contract objectives) and key performance indicators, while managing them on a real-time basis. Management’s decision-making process must start with those elements. That’s the only way to ensure that the firm will meet its profit objective.

The latest edition of “Architizer: The World’s Best Architecture” — a stunning, hardbound book celebrating the most inspiring contemporary architecture from around the globe — is now available. Order your copy today.